For Independent Power Producers (IPPs) that acquire solar assets after the development and design phases—rather than during them—the opportunities to address design issues or implement value engineering are more limited. However, it remains critical to involve an Owner’s Engineer (OE) or an Independent Engineer (IE) as early as possible in the project lifecycle to ensure safety, quality, and long-term operational performance.

In the first part of this two-part article, I outlined strategies for maximizing the value of third-party engineering services throughout project development and pre-construction. In this second part, I will focus on the specific value-added engineering services that Pure Power provides to IPPs during and after construction.

**IE or OE Engaged During Construction**

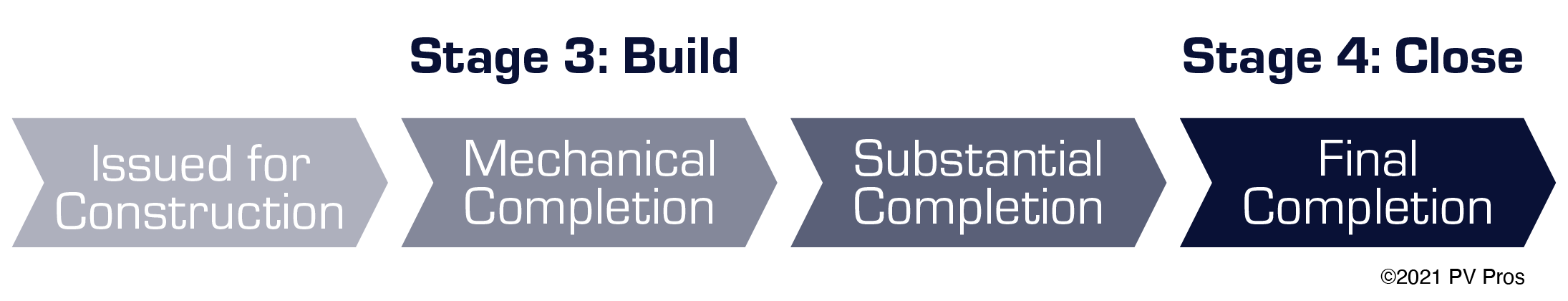

The transition from pre-construction to actual construction is marked by the release of the "Issued for Construction" (IFC) drawing set by the engineer of record. Once construction begins, the primary role of the IE or OE is to ensure that the delivered project aligns with the original design and specifications.

The earlier Pure Power is engaged as an OE or IE, the greater the value we can add. It's in everyone’s best interest for quality assurance and control (QA/QC) checks to begin as soon as construction starts. Addressing a problem in the early stages—such as a single row of panels—is far easier and less costly than fixing it after months of production.

**Quality Assurance and Quality Control (QA/QC)**

Verifying that the as-built conditions match the IFC drawings and project specifications is a key part of QA/QC. This includes visual inspections, insulation resistance tests, very-low-frequency (VLF) testing, polarity checks, and ground continuity tests. These steps are essential before system energization and commissioning.

During commissioning, all power equipment—including inverters, protection devices, transformers, and reclosers—are tested against the latest plans, energized, and operated. These tests follow manufacturer-approved standards such as NETA and IEC, including IEC 62446-1, which outlines requirements for testing, documentation, and maintenance of photovoltaic systems.

**Milestone Verification**

Major project milestones like mechanical and substantial completion often trigger significant progress payments. Lenders frequently engage Pure Power during construction to provide independent verification of milestone completions. As an OE, we also conduct site visits to support owners. Once milestone funds are released, the owner or lender loses leverage to correct deficiencies or bring the project into compliance.

**Performance Validation**

As discussed in a previous post, capacity and performance ratio tests are conducted based on detailed industry standards. When done correctly, these tests confirm that a solar asset is performing as expected. Performance validation is crucial when acquiring a solar asset, whether it’s newly built or already operational, as it helps de-risk the investment.

**IE or OE Engaged During Post-Construction**

For IPPs focused on acquiring operational assets, a specialized form of technical due diligence is required to understand the as-built conditions. This applies to both new and older systems. After construction is complete and commercial operations begin, it’s just as important to validate the PVsyst model as it is to evaluate the fielded design and construction.

Ideally, the system should be free of defects and safety hazards. However, even well-constructed systems may require further review and adjustment.

**As-Built Drawing Review**

As previously discussed, if record drawings do not match the actual installed system, it can lead to unnecessary costs and delays. A thorough review of as-built drawings is essential during asset acquisition to confirm that the physical system matches the documented one.

**Performance Analysis**

Since revenue from a solar asset is tied to the accuracy of the PVsyst model, it's vital to verify its correctness and make necessary adjustments based on real-world performance. This is especially important when acquiring an asset that has been operating for several years. Older systems may have different derate factors for soiling, degradation, and availability compared to new systems. Additionally, we can improve model accuracy by considering environmental changes like tree growth and using updated modeling software.

**Safety Evaluation**

After construction is complete, a key objective of technical due diligence is to ensure the solar asset is free from safety hazards. This includes plan reviews, QA/QC checks, and field inspections. Once an asset is acquired, any necessary repairs or modifications become the responsibility of the new owner, making early evaluation crucial to avoid costly future interventions.

By engaging experienced engineers like Pure Power at the right time, IPPs can significantly reduce risks and maximize the value of their solar investments.

Proportional Electromagnet

Guangdong Heidler Technology Co., Ltd , https://www.hyhemit.com